March 7, 2019: Karix Mobile, one of the leading solution providers of Unified Communications announced their association with Yes Bank for powering Yes Bank’s recent app-less banking roll-out. As part of their digital transformation strategy, Yes Bank adopted Karix Mobile’s actionable messaging platform to deliver app-less banking to their customers. This platform allows Yes Bank to deliver a suite of services to its customers over the mobile browser using progressive web-app technology.

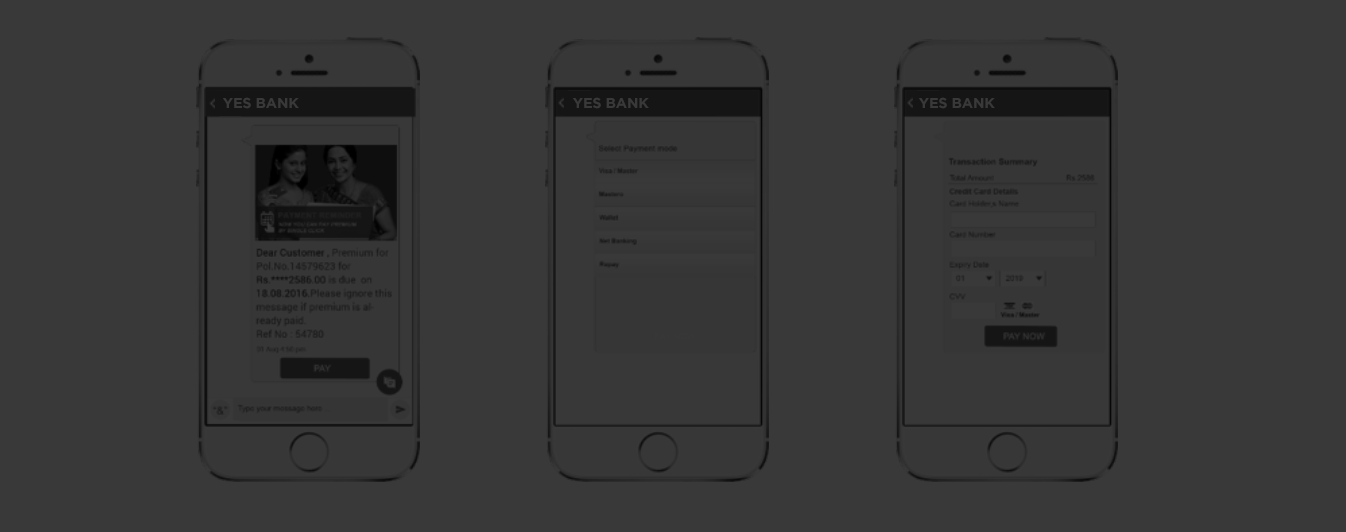

The challenge for Yes Bank and the banking industry today is to get their customers to download their various apps for internet banking. Using Karix’s platform, Yes Bank’s customers can now launch browser-based, chat-like applications with actionable buttons, to do basic banking transactions. The platform can integrate data, applications and channels seamlessly, allowing Yes Bank to deliver multiple micro-experiences over various mobile channels such as SMS, WhatsApp etc.

Anup Purohit, CIO, YES Bank shares the importance of the platform for the bank’s digital strategy. He says, “What excites me most about Karix Mobile’s platform is its ability to co-create and deliver multi-domain business use cases, in an agile manner which leverages modern application architecture principles using Azure PAAS”. The platform is integrated with Microsoft Azure for faster Cloud deployments.

“We were looking for a smart and lightweight workflow management solution which is built on a future proof modern architecture (Container based technology, using micro-services and delivered in PAAS Mode). However, upon evaluation of Karix’s Business Process Automation (BPA) solution, we were pleasantly surprised on its additional features notwithstanding a brilliant, easy to use Business Process Manager (BPM) which included an Actionable Intelligence platform delivering Progressive Web Apps as the front end for quick actions. This solution is a state-of-the-art ‘Digital Fabric’ having end-to-end delivery capabilities which helps in actualizing our Digital strategy including delivering the solution in PAAS mode”, adds Anup Purohit, CIO, Yes Bank.

Yes Bank can now offer improved customer journeys to ensure problems are addressed with minimum response time at the first instance, resulting in a higher level of customer satisfaction. Yes bank can easily direct their queries to self-service modules via a link over SMS, or their existing chat-bot or WhatsApp, thereby empowering customers, improving response times and reducing the load on their customer service team. Extensive out-of-the-box business functionalities also support corporate, trade finance and other treasury related workflows.

“To enable banking enterprises to rapidly deliver digital engagements to their customers via an extremely agile and lightweight compute platform, Karix has been investing in responsive, modern and scalable digital messaging solutions. We want to eliminate app dependencies for quick launch of use-cases that can be delivered for a device agnostic, consistent experience for end users,” says Deepak Goyal, COO, Karix Mobile.

The USP of Karix Mobile’s actionable messaging platform is that it combines push timeline based messaging with PWA technology that enables the actionable UI use of the device’s native features such as the camera, location services, fingerprint scanner etc. to provide personalized banking services, location-based services with reliable security like Two Factor Authentication (2FA), pattern and PIN.

Digitally advanced enterprises, such as Yes Bank that realize the importance of creating relevant micro experiences and shifting focus from products to customer demand and behavior are more likely to survive in an ‘app-less’ world. As an early adopter of Karix’s advanced first-of-its-kind ‘customer engagement platform’, Yes Bank has positioned itself as a digital leader with the ability to integrate technology to transform the way customers and banks interact.